2020 Census Data Released

The U.S. Constitution requires a national headcount every 10 years and the information is then used to determine how the 435 seats in the House of Representatives are divided up among the 50 states in a process known as apportionment. A lot is at stake. Not only does apportionment have political impacts in relation to party representation in the House, it also affects the distribution of $1.5 trillion in federal spending each year.

On Monday, the Census Bureau released the first results from the 2020 Census, showing the 7.4% population gain is the second lowest growth rate since the 1930s (when the U.S. population grew 7.3%). Also released was broad population data showing slowed growth in the Northeast and Midwest and gains in the South and Mountain West, shifting political power more toward those two regions. In fact, the South grew 10.2%, more than twice the rate of the Northeast or Midwest. In sum, five states will each lose one House of Representatives seat: California (for the first time in history), Illinois, Michigan, New York, Ohio, Pennsylvania, and West Virginia. Had New York counted 89 more people, it would have retained its seat and Minnesota would have lost one. Gaining a seat will be Colorado, Florida, Montana, North Carolina, Oregon, and Texas, which will gain two seats. Redistricting will now occur in the affected states.

Demographic information and raw population data for counties, cities, towns, etc. will be released beginning August 16.

A Higher Capital Gains Tax?

President Biden released a proposal Wednesday evening titled the American Families Plan, which includes measures such as expanding subsidies for childcare, universal preschool for 3 and 4-year olds, and free tuition for two years for all Americans at community colleges. The proposal would also provide money to make childcare more affordable for low and middle-income families and boost federal funding to child-care providers. It would also establish a national paid-leave program for those needing to take time off from work to care for a child or family member. The White House said the proposal includes $1 trillion in new spending over 10 years and $800 billion in tax cuts, primarily extensions of tax breaks created or expanded in this year’s COVID-19 relief law, the American Relief Plan, enacted in March. The proposed American Families Plan package follows the $1.9 trillion American Relief Plan and is on the heels of another proposed $2.3 trillion infrastructure package, funding for which the Biden Administration has proposed increasing the corporate tax rate from 21% to 28%, as well as marginal income tax rates on certain high earners.

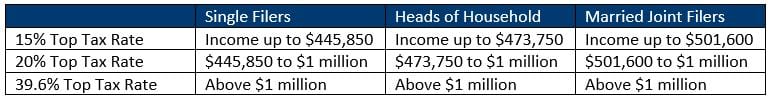

To pay for the American Families Plan, the Biden Administration proposes to increase the long-term capital gains tax rate from 20% to 39.6% for those with incomes greater than $1 million. When factoring the Affordable Care Act surcharge, the wealthiest taxpayers will pay 43.4% on investment returns or other assets held longer than a year, up from the current 23.8%. The proposed tax increase would also expand the 3.8% Net Investment Income Tax to types of income not currently covered, namely active income earned in business partnerships and S corporations above $400,000.

Below are the top rates that would apply to investors in several filing statuses and with various levels of annual income:

While stocks and other asset values fell on the news last week, munis remained steady and the proposed tax increase could be another tailwind bolstering demand for tax-exempt municipal bonds. That said, it is difficult to predict exactly what will happen as there a number of current legislative proposals that could be advantageous or detrimental to tax-exempt borrowers.

Market Recap

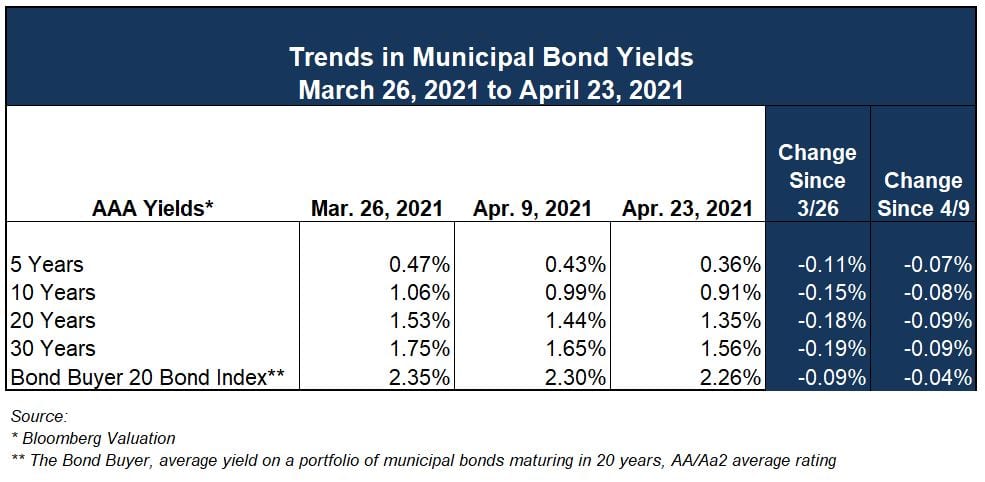

Municipal bond yields have been mostly flat to slightly lower these past few weeks, though they remain a bit higher than recent all-time lows. U.S. Treasury rates have risen since the beginning of the year, but for largely positive reasons. First quarter GDP data was released Thursday morning indicating the economy expanded 6.4% (seasonally adjusted), in part due to increased COVID vaccinations, falling infections, and more fully reopening local economies. This means the U.S. economy is just 1% below its pre-pandemic peak. In fact, as The Wall Street Journal reported recently, consumers’ outlook on the economy has increased for the past four consecutive months. The April consumer confidence index increased to 121.7 from a revised 109.0 in March, which is starting to approach the pre-pandemic level of 132.6 reported in February 2020.[1] The continued rise in confidence should bode well for consumer spending in the next few months, but as we previously discussed in our prior Commentary, some market pundits are worried the recovery may be too hot and will prompt greater inflation. Clearly prices are rising for many consumer staples, capital goods, and raw materials, which could dampen economic activity.

In his most recent remarks, Chairman Jerome Powell said he expects output and job growth to accelerate in the coming months, but also reiterated the Fed intends to wait until the economy’s recovery is complete before it raises rates. However, Fed policymakers did reference mildly higher inflation measures at the conclusion of this week’s Federal Open Market Committee (FOMC) meeting. The FOMC also reaffirmed the Fed’s current pace of bond purchases at $120 billion per month.

In sum, the municipal market is presently enjoying several tailwinds, including better than forecasted state and local government 2020 tax revenues, increasing consumer spending, and travel and tourism approaching pre-pandemic levels. Given these developments, rating agencies have responded by changing their outlook on many municipal and non-profit sectors from negative to stable. However, some headwinds do exist, particularly the risk of rate volatility and the aforementioned increase in the costs of goods and serves, much of which is attributable to supply chain and logistics challenges.

That said, new-issue supply in the municipal market remains on the lower side and investor demand continues to be solid. The biggest wildcards in the near future are if fiscal spending and borrowing pushes U.S. interest rates markedly higher, along with the uncertainty and corresponding volatility created in financial markets whenever major changes to tax policy are made.

[1] https://www.wsj.com/articles/confidence-in-u-s-economy-approaches-pre-pandemic-level-11619541929?mod=hp_major_pos1#cxrecs_s

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.